For many families, owning land is a rewarding way to build wealth while creating a tangible legacy for future generations. But along with claiming a slice of the American dream, land ownership carries a number of responsibilities, including the annual payment of property taxes, having an estate plan, and articulating one’s vision for the use of the land by future generations.

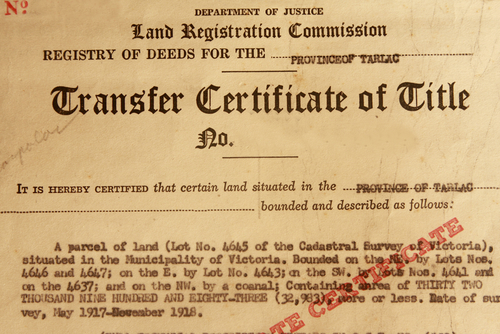

If a Florida resident owns land located in multiple states and dies intestate (without a will), transferring ownership of the property to his/her Florida heirs can become extremely complex and expensive due to what is known as “ancillary probate.” In ancillary probate proceedings, the laws of the state where the land is located – not the state in which the decedent resided- dictate what will happen to the property after the owner dies. The process becomes even more complicated if the property has changed ownership over the years without a corresponding change in the name on the title.

The following case example involving Uncle Hal and Aunt Sally (not their real names) illustrates how mistakes in stewardship of the land and the lack of proper estate planning can thwart the best intentions to create a lasting legacy of land ownership for heirs.

Landowners Uncle Hal and Aunt Sally Each Die Intestate

Brian (not his real name) came to see us in 2012 at the request of his adult children who were assisting him in managing his financial and legal affairs. They discovered that Brian, a Florida resident, was paying annual property taxes in New Hampshire and Arizona for real estate titled in the name of his long deceased Uncle Hal. A Florida resident at the time of his death, Uncle Hal died in 1982 without a will or a trust, so his wife, Sally, inherited the real property under Florida law. In 1999, Aunt Sally died without a will or a trust, and under the Florida intestacy statute, Aunt Sally’s nearest relative, her brother Brian, inherited her estate.

Probate Quagmire: Three States, Two Years, Six Separate Probate Proceedings

During Brian’s initial meeting with us, he explained that there was a “slight problem” with the title to the properties located in Arizona and New Hampshire which were still in Uncle Hal’s name. We informed Brian that we could handle the Florida probate proceedings relating to his inheritance from Aunt Sally; however, in order to get the land transferred from Uncle Hal’s name to Aunt Sally’s name and then to Brian’s name, we would have to co-counsel with attorneys in New Hampshire and Arizona regarding the ancillary probate proceedings in each respective state. We cautioned Brian at the beginning that the biggest drawback of ancillary probate in multiple state jurisdictions is the multiple court fees, accounting fees, and attorneys’ fees.

Two years and thousands of dollars in legal fees later, we facilitated three probates in three states for Uncle Hal, and three probates in three states for Aunt Sally – just to get the title of the property into Brian’s name. That’s a total of six separate probate proceedings and a lot of money out of pocket for Brian.

The Solution Moving Forward: Titling the Land into a Trust-Based Plan

In order to ensure that Brian’s heirs were spared the expense and delays associated with probate proceedings, we drafted a trust-based estate plan for Brian. As soon as the six probate proceedings were completed and Brian was named the owner of the properties in Arizona and New Hampshire, we suggested titling the land into Brian’s living trust. Then, when Brian dies, his children would not need to open up a probate in Florida, New Hampshire, or Arizona to inherit the land. The title transfer after Brian’s death would be handled by Brian’s successor trustee, not the probate court.

Planning Checklist: A Tool to Help Clients Plan for Ownership Succession of Land

If you own land, proper estate planning is a necessary step to ensure that the legacy of your land passes seamlessly to your heirs. In addition to helping ensure the financial security for your loved ones, estate planning can often minimize taxes and enable you to pass on your family’s legacy and assets according to your wishes and without costing your heirs substantial probate fees. We encourage you to use this planning checklist and to share it with your family members.